Mark Twain famously said, “History doesn't repeat itself, but it often rhymes.” From our perspective, we couldn't agree more with this quote. We don't expect history to repeat in the same fashion but do believe that it can provide insightful clues as to what may happen in the future.

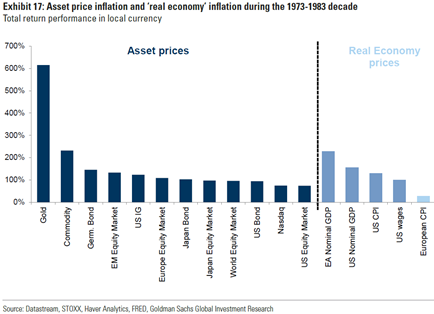

Even though we don't expect to see hyperinflation in the U.S. as we experienced in the 1970s, we believe studying that period can provide some insights as to which different asset classes may perform better in inflationary times. The chart below shows how different asset classes performed in the inflationary period from 1973 to 1983 and shows the clear winners were real assets. We suggest investors have some exposure to real asset classes in their portfolios!

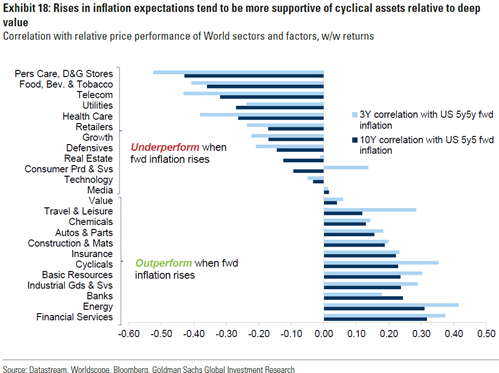

Investors that want a more granular look at which industry sectors and factors perform well during rising inflationary periods can refer to the next chart. The chart shows which segments have historically performed better during inflationary times; the best performers have been financial services, energy, industrials, and basic resources. Again, we suggest investors have some exposure to these areas as a hedge against rising inflation in their portfolios. As investors, we always need to look forward as we design portfolio strategies, however, sometimes looking back at history can provide the best clues.