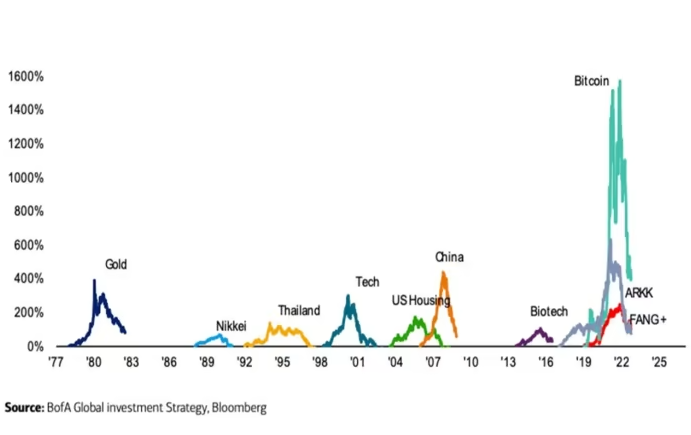

Can You Spot the Bubble(s)?

We have written several times over the past few years warning about the speculative nature of crypto assets. We continue to track the evolution of the crypto space and a recent paper from the Bank of International Settlements (BIS) caught our attention. The paper looked at the usage of over 200 different crypto-trading apps around the world from 2015-22. The Financial Times summarized the key findings of the BIS paper, see below:

- Bitcoin's early 2021 bull run lured in 511 million new monthly active users around the world. At bitcoin's peak in November 2021, nearly 33mn people were trading crypto on an average day.

- When bitcoin prices rise, smaller bitcoin holders buy and big holders sell. The most eager buyers into rising prices are the smallest, holding fewer than 1 bitcoin. Holders of 100,000 or more bitcoin, often called whales, used rising prices to cash out.

- Some four-fifths of bitcoin investors probably lost money. This is a rough estimate based on debatable assumptions. But the high four-fifths figure reflects the fact that 73 percent of crypto phone traders downloaded their app when bitcoin was above $20,000. It now trades closer to $17,000.

- The crypto traders were disproportionately men under 35. This demographic profile fits with other research that found bitcoin adopters were largely educated, young, tech-savvy, and male.

The findings support the case that bitcoin/crypto was a speculative creation that reached mega-bubble status. History suggests that bubbles take years to recover their losses, it will be interesting to watch where bitcoin and other cryptocurrencies go from here!