Winning by Losing Less

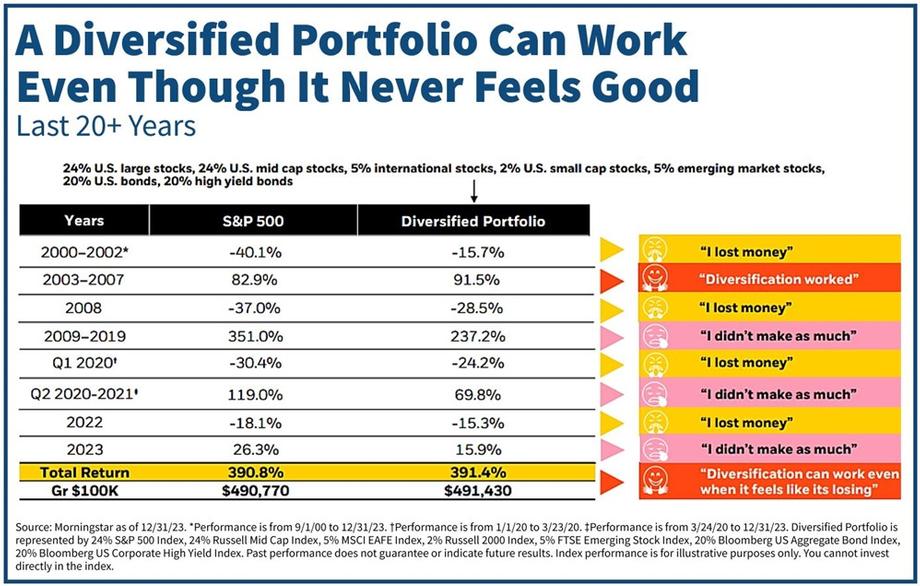

Over the past twenty years diversification has been a winning strategy, although it hasn't always felt that way. A well-diversified investment strategy can help you achieve your long-term goals but is likely to limit both the ups and downs in your investment returns. Implementing a diversified portfolio strategy can be more challenging than it seems. Mainly because in strong up markets it can feel like you are not keeping up with the best-performing parts of the market, the S&P 500 in recent times, and in down markets a diversified portfolio is likely to lose money, just not as much as a concentrated strategy of just S&P 500 stocks. Even though it may never feel great in a given year, diversification works in both the short and long run!

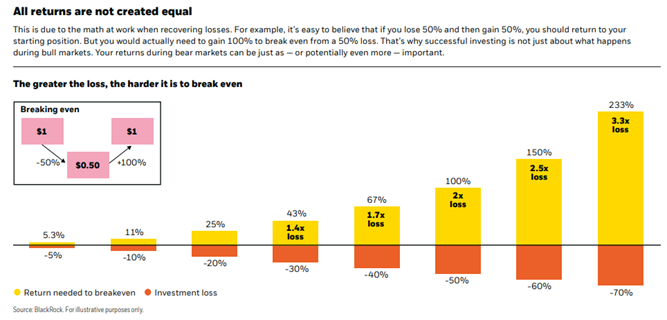

It is Simple Math

As the chart below shows, having fewer big declines in your portfolio can lead to better long-term results. The chart highlights a study from BlackRock that compared the returns of an all-S&P 500 portfolio to a diversified portfolio over the past twenty years. It is interesting to note that the diversified portfolio actually performed a little better than the S&P 500, but did so with a heck of a lot less volatility than an all-stock portfolio. That sounds like a winning strategy to us and reflects the approach we use at AWM to meet the investment goals of our clients. The goal of diversification is to keep people invested in hard times. Looking at the -40.% return of the S&P 500 from 2000 to 2002 would have tested the resolve of a lot of investors but a much lower -15.7% return allowed them to stay invested and focused for the long term.