Commodity Price Shocks and Recession Risk

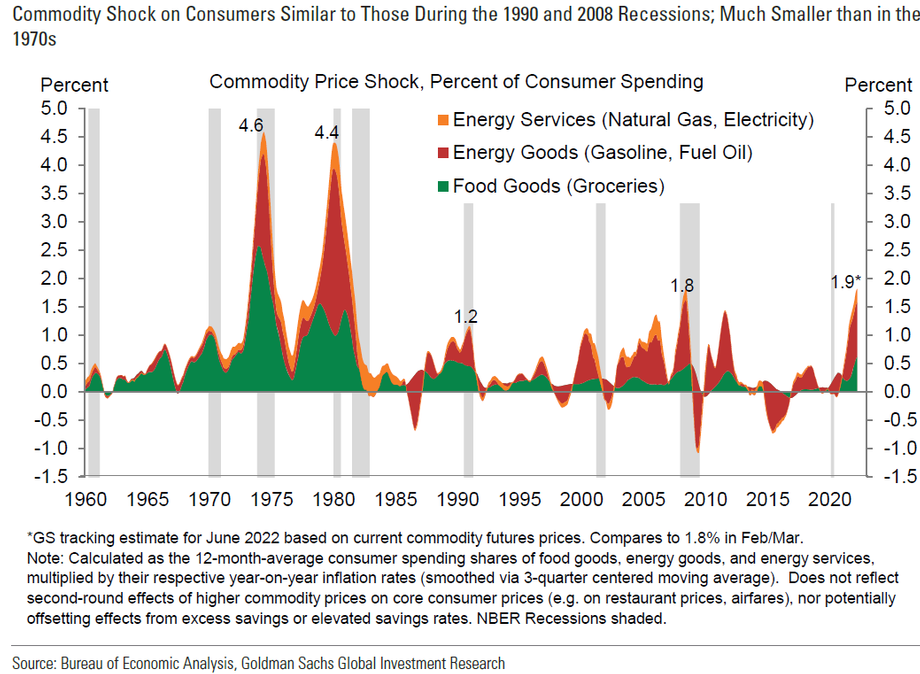

Recent geopolitical turmoil, rising commodity prices, and monetary tightening have increased US recessions risks. Goldman Sachs recently did a study on the impact of commodity price shocks and recessions, here are some of the highlights from their findings. They discussed the impact higher oil prices, natural gas, and agriculture prices have had on US consumer spending. In the current cycle, they estimate consumer spending increased by 1.9% due to higher commodity prices. The chart below shows this increase is in-line with the commodity shocks and recessions experienced in 1990 and 2008, but much lower than the price shocks of the 1970s.

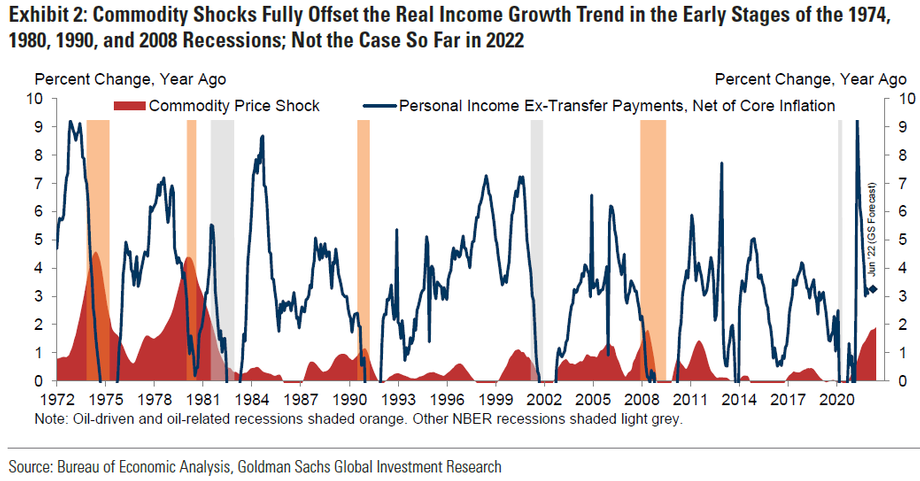

However, their study found the absolute size of the commodity shock is a less reliable predictor of recession than the size of the price shock relative to personal income growth. Based on this, today's risk of recession looks much lower. The chart below shows how in the early stages of the recessions of 1974, 1980, 2005, and 2010, commodity price shocks fully offset the trend in real income growth—implying there was no scope for consumption to rise without drawing down savings. That is not the case today, thanks to strong payroll and wage gains, nor was it the case during commodity upswings and continued expansions of 1999, 2005, and 2010.

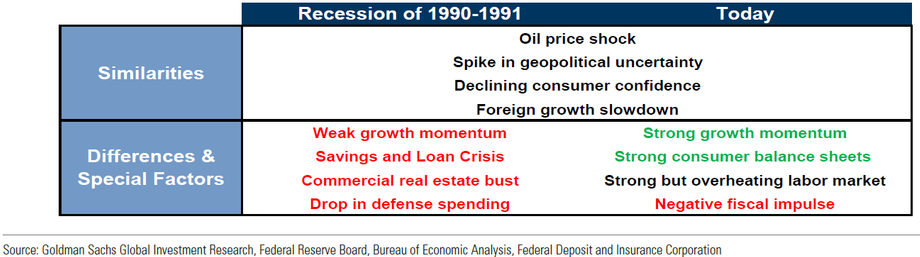

As part of the study, Goldman highlighted the similarities and differences of today's environment with the Gulf War period and the recession of 1990-1991, which has many parallels to today. Their conclusion is the environment today has enough significant differences (stronger balance sheets, excess savings, etc.) that a recession will likely be avoided, see the table below. In fact, they estimate it would take a sustained oil price of $200 per barrel to produce an income shock that may lead to a recession.

Clearly, risks to the economy have increased in the past few months and evolving geopolitical events may increase them further. However, at this point, a recession in the year ahead should not be the base case for investors.