The long-term case for commodities and resource stocks:

One of our favorite research providers, GMO, recently published a research report on the long-term outlook for commodity prices and resource stocks. We thought the case they made was compelling enough to share their executive summary and some highlights from the report, see below.

Executive Summary: Commodity prices have soared, and inflation has hit levels not seen since the early 1980s. Due to long-term supply/demand dynamics in commodity markets, we may have to get used to high prices in the years to come. Resource equities (stocks) trade at deeply discounted levels and offer investors both a chance to benefit from high commodity prices and to protect their portfolios from inflation. While there are always risks in the resources sectors, they believe investors are likely to be rewarded with a compelling mix of strong returns, inflation protection, and diversification.

Highlights: Below are a few charts we've pulled from the report that supports the case for investing in resource stocks. We've added comments to each chart to provide context.

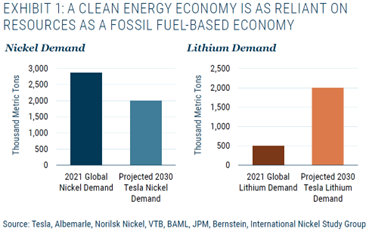

The demand for commodities will remain strong for decades and will come from both developing countries that want to build out their economies and the growing demand for clean energy materials. For perspective, the chart below illustrates how dependent the clean energy economy is on resources. It highlights, the projected demand from Tesla alone for nickel and lithium in 2030 compared to the total global demand in 2021. Tesla is only one electric car company, when your project demand for all the other clean energy providers, demand will be huge!

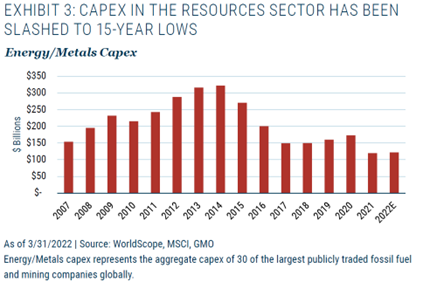

A key reason why commodity prices are so high today is a lack of investment over the past decade. The next chart shows how capital expenditures have been declining since 2014 and are at a 15-year low. This lack of investment will impact commodity prices for years to come.

The global demand for clean energy is ramping up sharply, however, the transition is likely to take decades. Below are estimates for projected energy consumption by different sources, showing the reality that it will take a long time to transition away from traditional energy sources.

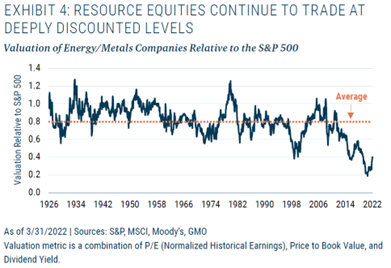

Since the 1920s, resource companies have typically traded at around a 20% discount to the S&P 500 (chart below), today they trade at close to a 60% discount to the S&P 500. Surprisingly, resource companies have outperformed the S&P 500 by over 2% per year since the 1920s. At today's discount, the outperformance may be greater.

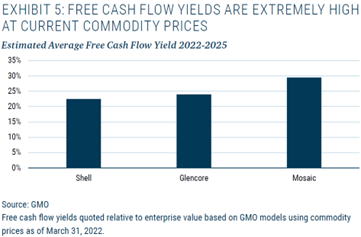

Below is an example of the impact higher commodity prices can have on the profitability of resource companies. The chart highlights three companies and the extremely high free cash flow they are able to generate when commodity prices are high. These are just examples, not recommendations.

For full disclosure, we currently invest in the GMO Climate Change fund which has exposure to a lot of the commodity trends and resource companies discussed above. Another good way to invest in resource companies would be to select a broad-based exchange-traded fund (ETF), such as the S&P Global Natural Resources fund. As is always the case in the resources sector, risks can be high so investors should make sure it fits their risk tolerance before making investments. If you have questions on the commentary or want to discuss how to invest, please give us a call.