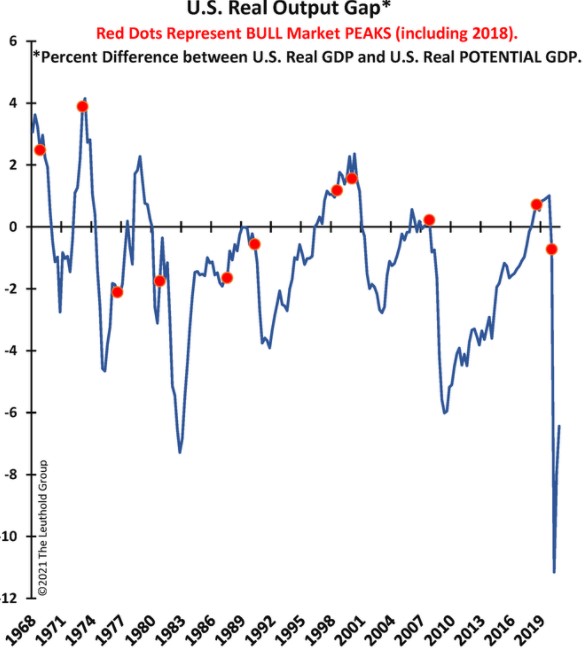

There are several reasons to be concerned about the stock market: valuations are high; signs of excessive trading and bubble activity (SPACs, Bitcoin, Robinhood trading, etc.); and increased volatility. However, there are several signs that we are in the early stages of an economic recovery and there is more room for financial markets to continue higher. One of those signals is the U.S. Real Output Gap (ROG), which is simply the difference between U.S. Real GDP and U.S. Real Potential GDP. The chart below from the Leuthold Group shows the ROG is still very low at (-6.5%), well below where we have previously seen bull markets peak. This doesn't suggest we won't see any corrections but it does suggest there may be more room for economy and markets to recover.