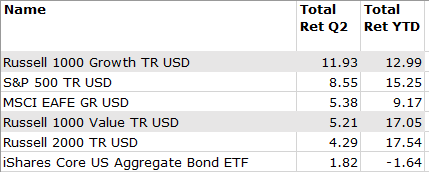

Starting in mid-May, investor expectations shifted towards a slowing economy and bond yields dropped sharply, leading to a big outperformance of growth stocks for the quarter. Growth stocks were up 11.93% vs. value stocks at 5.2%, with most of that outperformance coming in the last 45 days of the quarter. However, for the year-to-date (as of 6/30) value stocks still hold a big advantage, up 17.05% compared to 12.99% for growth stocks. A result of big outperformance in the first quarter and early part of the second quarter. The debate of whether economic growth will remain strong or start to weaken will have a big impact on performance going forward. The table below illustrates the dramatic rotation in performance for growth and value stocks this year.

Some of the reasons why the current economic cycle is only at a mid-point and not headed for a recession anytime soon include: strong earnings, massive stimulus, extremely low real yields, etc. The Leuthold Group recently published research that supports a positive outlook for financial assets. The chart below highlights how stocks have historically outperformed during environments of falling bond yields and improving earnings (like we are currently in). In general, this has been a positive backdrop for stocks, leading to both higher returns on average and lower odds of a market sell-off. According to their study, the best performing investment styles for this type of environment has historically been high dividend stocks, value stocks and small-cap stocks, while growth stocks typically underperformed.