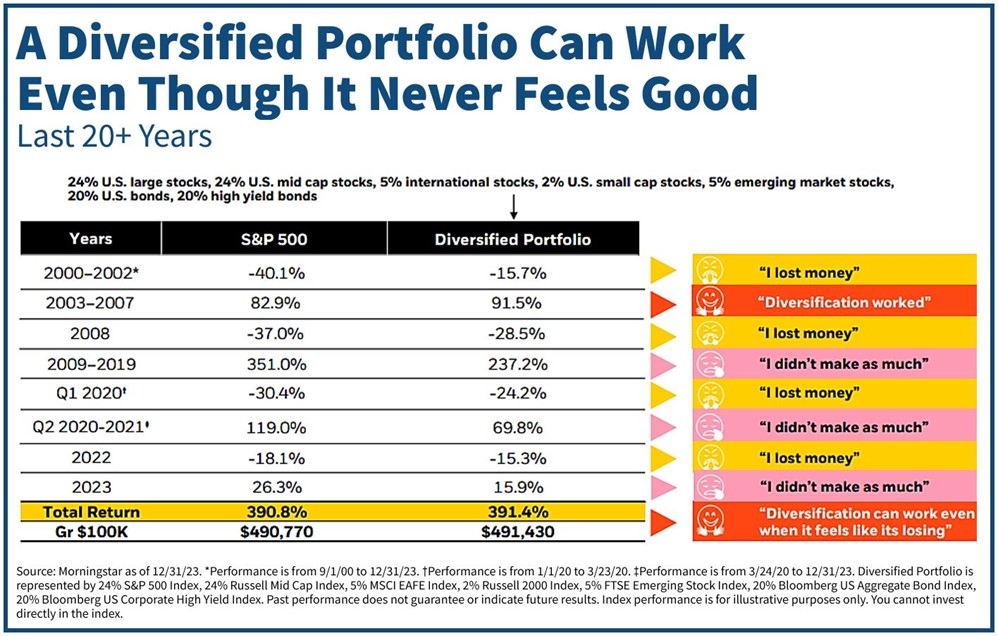

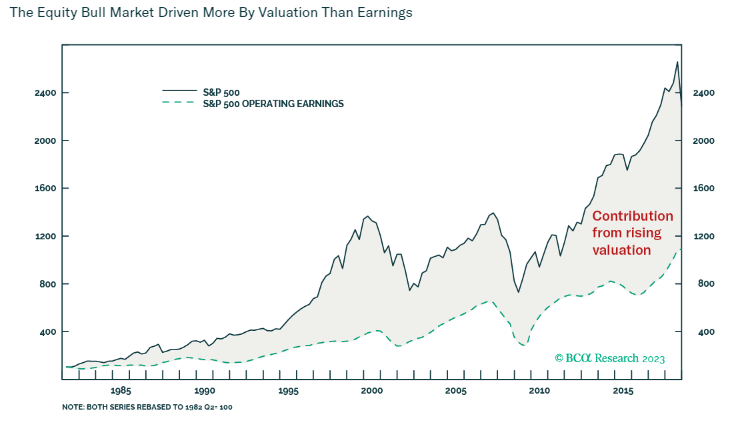

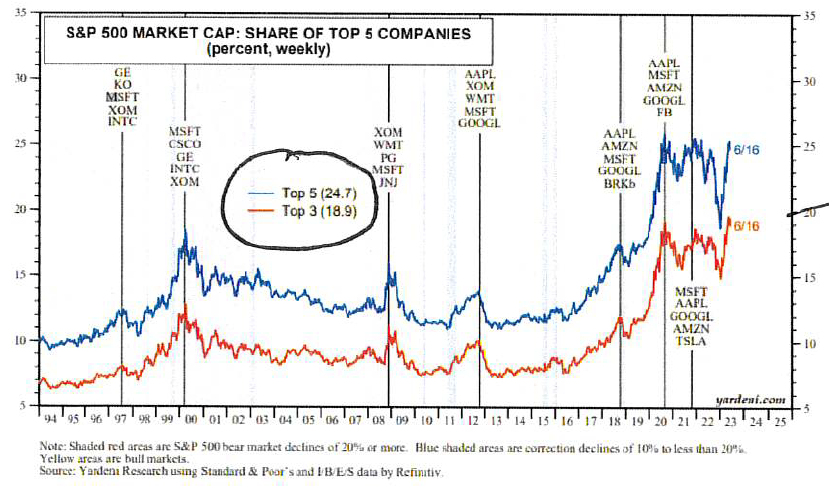

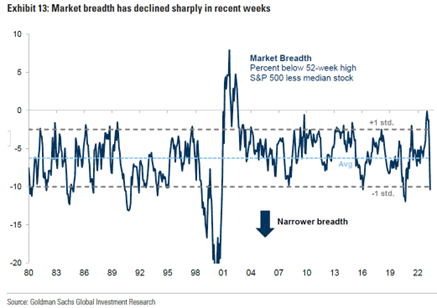

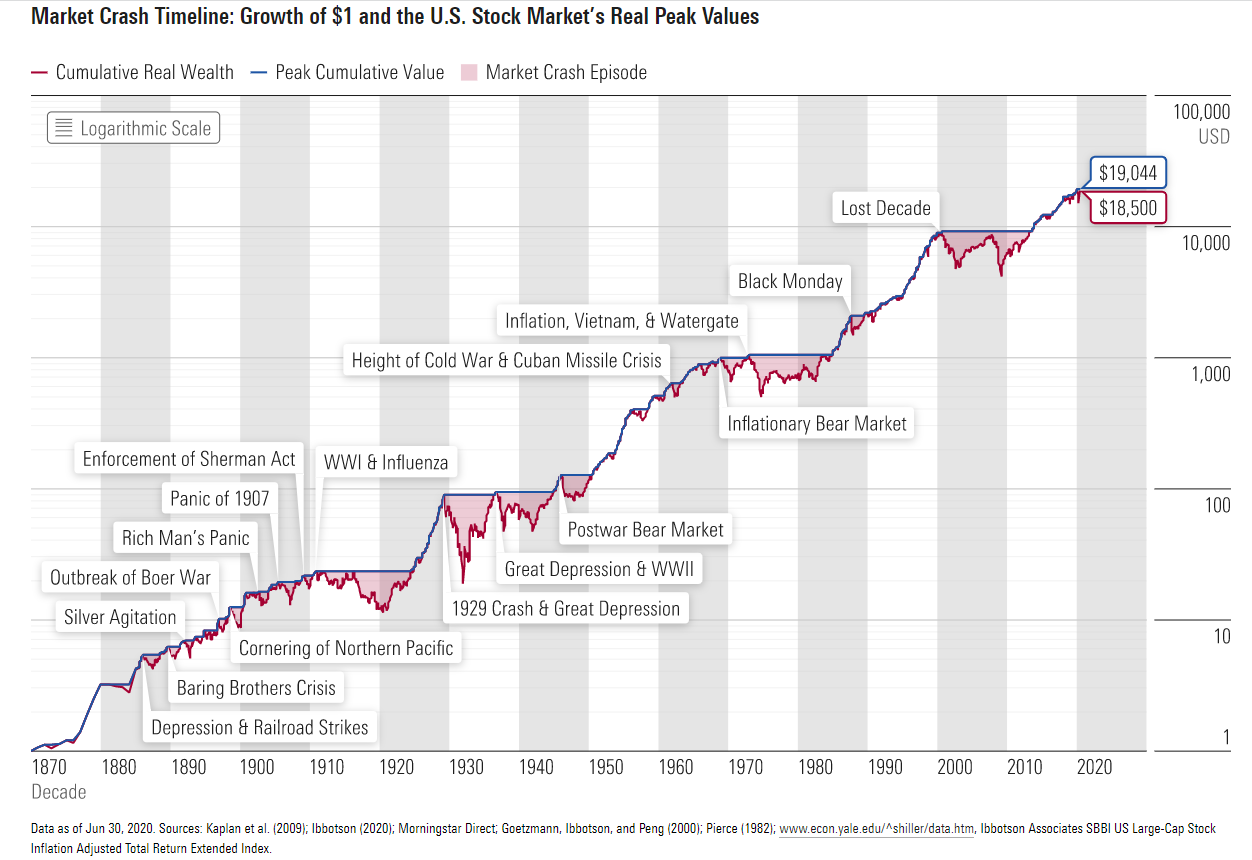

So far in 2023, market performance has been the inverse of what happened in 2022. In 2022, we saw significant outperformance from quality, divided, foreign, and value stocks, as well as commodity/real return investments, while growth and technology stocks lagged by a wide margin. In 2023 the market has been led by growth and a handful of technology stocks, while other parts of the market have lagged by a wide margin.

View More >>